Destinations and Requirements

Austria

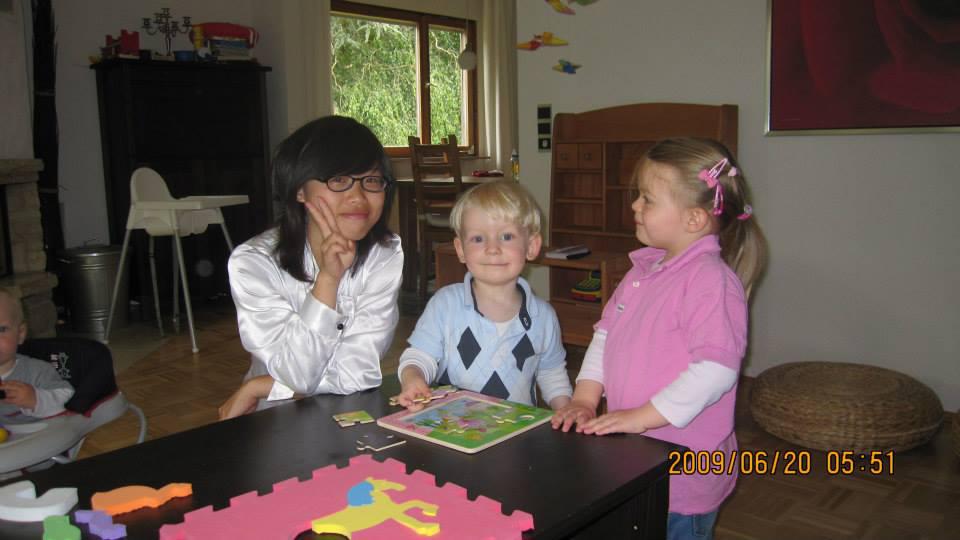

The tradition of au pairing is well established in Austria, and prospective au pairs are served by several agencies who are accustomed to dealing with direct applications from foreigners. Requirements are not strenuous, and many inexperienced 18-year-olds are placed. The norm is for the agencies to charge their au pairs a fee equivalent to a week’s pocket money.

Officially, au pairs from outside Europe must obtain both a work and residence permit (Beschäftigungsbewilligung). The employing family should apply at their local employment office at least two weeks before the start date. Before the permit can be approved and an Anzeigebestätigung issued, the authorities must see an agreement or contract (signed by the employer and the au pair) and proof that health and accident insurance cover has been obtained by the au pair. The agency should help with this process and tell the au pair where to take the documents to be stamped (for a fee).

Germany

Many independent agents are members of the Au Pair Society which has two offices in Germany and more than 40 members. The Society’s web site carries contact details for its members with links to agency web sites. Commercial au pair agencies do not charge a placement fee to incoming au pairs.The monthly pocket money for an au pair in Germany was raised to 260 euros ($300+) in 2006. The majority of families also give their au pairs a monthly travel pass and other benefits such as a contribution to course fees or travel expenses.

Application criteria

Potential au pairs must:

Be 18–30 years old

Have some child care experience.

Be a non-smoker and non-drug user. Some families will accept smokers.

Display basic conversational language ability Level A1 Be able to make 6 to 12 month commitment. Shorter placements of three months can also be arranged but only for citizens of the European Union (not including new EU members as they need a work permit).

United States

Interest in the Au Pair Program in the United States began in 1987 when two educational and cultural exchange agencies were designated by the United States Information Agency (USIA) to conduct a program under the Fulbright–Hays Act of 1961 that would allow foreign nationals the opportunity to live with an American host family and participate directly in the home life of the host family. After testing the program with approximately 200 Au Pairs, Congress instructed that the program be continued and the Au Pair Program was officially enacted in 1989. In that same year, the program was expanded to include four additional agencies and collectively, these agencies became the original six government designated Au pair organizations in the United States.

The United States au pair program offers qualified young people the opportunity to live and study in the U.S. for one or two years in exchange for providing up to 45 hours of childcare per week. The au pair program was recently granted permission from the U.S. Department of State to offer a second year extension au pair program (6, 9 or 12 months), as well as a summer au pair program.

At the same time, the au pairs are required to complete an educational component of six semester hours of academic credit or its equivalent. At the end of one year, au pairs generally return to their home country, unless they and their host families choose to extend their stay for a further 6, 9 or 12 months. Alternatively, the au pair can choose to extend her period in the US with a different family. Most au pairs choose a family in a different part of the country, allowing them to have a new experience.

The rules of the Au Pair Program in the US are: au pairs are provided a private bedroom, meals, remuneration tied to the minimum wage ($195.75 per week as of 24 July 2009), 11⁄2 days off weekly plus a full weekend off each month, two weeks' paid vacation and the first $500 toward the costs of required course work to be completed at an accredited institution of higher education in order to satisfy the requirements of the educational component of the program. Au pairs are not to work more than 10 hours per day or 45 hours per week, and are not to serve as general housekeepers or assume responsibility for household management. The US EduCare Au Pair Program is also available for families with school-age children. In this program, the au pair works a lower number of hours (not more than 10 hours a day and not more than 30 hours a week) for a weekly minimum wage of $132.64 (raised to $146.81 on 24 July 2009 in accordance with the federal minimum wage increases). The family pays $1000 in educational expenses, and the au pair is required to complete 12 hours of academic credit. Au pairs placed with families who have children under two years old must have at least 200 hours of child care experience with infants under two. Au pairs may only be placed in a family with an infant under three months old if a parent or other adult caregiver is also home and fully responsible for the infant.

The Au Pair Program is administered by the US Department of State. Participating families and au pairs must work with one of the currently 12 approved agencies. Au pairs enter the United States on a J-1 visa. According to the Internal Revenue Service, an au pair will almost always be a nonresident alien, and will be required to file a tax return on Form 1040NR or Form 1040NR-EZ to report his or her au pair wages. Au pair wages, however, are not usually subject to social security and Medicare taxes because of the au pair's status as a J-1 nonimmigrant and as a nonresident alien. However, if the au pair had previously been in the United States as a student, teacher, trainee, or researcher in F, J, M, or Q nonimmigrant status, then the au pair might be a resident alien during his current stay in the United States, and might be subject to social security and Medicare taxes if his annual au pair wages exceed the applicable dollar threshold found in IRS Publication 926. If the au pair is a resident alien and his or her annual au pair wages exceed the applicable dollar threshold, then the host family must withhold social security and Medicare taxes and report them on Schedule H of Form 1040 and on Form W-2. The host family will need to apply for an Employer Identification Number (EIN) if it is required to withhold tax and file Form W-2.

Basic application criteria

Potential au pairs must:

be aged 18–26

have professional or practical childcare experience for at least 200 hours if looking after a child under 2

agree to commit to a full year’s stay in the USA and be prepared to provide up to 45 hours of childcare a week

have completed their secondary school education.

be proficient in spoken English

have no criminal record